If you run a business with a vehicle fleet, an effective way to save money on your tax bill is to report your business mileage to HMRC for tax reimbursements. To benefit from a tax deduction, businesses need to keep detailed records of every trip and prove to the HMRC that the trips were for business purposes. But, HMRC won’t just take a company’s word for it; they require comprehensive mileage logs as proof.

Fuel bills make up a considerable share of total expenses for fleet businesses. Recording business mileage for tax reimbursements can be a hassle – especially when done on paper – but the benefits are worthwhile. The latest feature of GPSLive tracking software – Trip Log, enables business owners to identify business and private uses of fleet vehicles, allowing managers to easily distinguish mileage done by company vehicles between business and personal service for tax reimbursements. GPSLive enables companies to record all trips done by vehicles in their fleet; once the data is collected from your vehicles, the new Trip Log feature can identify the mileage and figure out tax-deductible business trips.

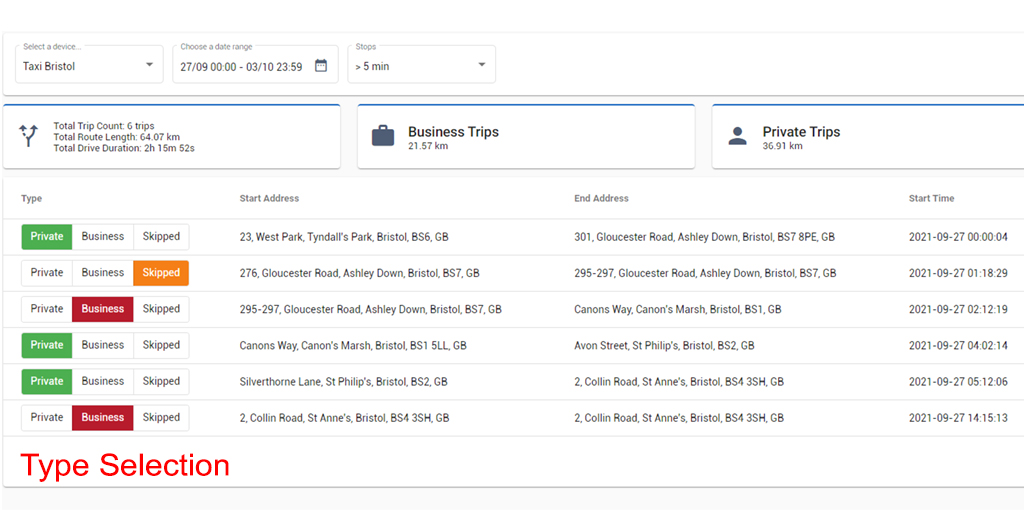

The less time it takes for the drivers and the managers to cover an expense claim, the more productive your fleet will be. Trip Log is an essential tool for fleet businesses as it gathers data from vehicle trackers to create a brief and to-the-point mileage and fuel usage report. Fleet companies can claim thousands of pounds per vehicle a year on mileage deduction alone. With the Trip Log feature, managers can track every trip taken by the fleet drivers, even if it is just a block away, giving the company the maximum tax reduction. Trip Log allows the user to select between; business, personal, or skip that trip.

The HM Revenue & Customs doesn’t allow companies to estimate their data. The mileage logs need to include detailed information such as the distance traveled, the date of the journey, the purpose – business or personal, destination, and the start point. Businesses have access to all the necessary information required by the HMRC through the Trip Log feature. Without reliable records and precise data, a company may not be able to benefit from the mileage deduction service to the full extent.

Business owners and managers need to know what qualifies as a business trip. Unauthorized vehicle use is a well-known issue among fleet companies and submitting wrong information for tax deduction is a punishable offense. HMRC has specific standards to help executive teams decide when trips are classified as business-related and when they aren’t. As a rule, if a trip is business-related:

1- Employees such as truck drivers and delivery personnel can’t do their work unless they complete a trip to the destination. If driving is one of an employee’s primary responsibilities, their trips are generally considered business trips unless it is an unauthorized vehicle use.

2- Service technicians, sales agents, lone workers, and similar professions require employees to travel to locations other than their usual workplace to carry out their duties. This rule generally applies in cases where employees perform maintenance on a remote job site or drive to a client meeting.

| Type of vehicle | Rate per business mile 2018 to 2019 |

| Car | For tax purposes: 45 pence for the first 10,000 business miles in a tax year, then 25 pence for each subsequent mileFor National Insurance purposes: 45 pence for all business miles |

| Motorcycle | 24 pence for both tax and National Insurance purposes and for all business miles |

| Cycle | 20 pence for both tax and National Insurance purposes and for all business miles |

Source: https://www.gov.uk/guidance/rates-and-thresholds-for-employers-2018-to-2019

The rates for mileage reimbursement are calculated based on certain factors such as the changes in gas prices and maintenance costs. The cost of operating a vehicle changes every year that is why the rates are subject to change annually. The mileage deduction is intended to cover the operating costs of vehicles for fleet businesses. The operational costs that are evaluated are; repair costs, taxes, gas prices, insurance, and registration fees. Mileage deduction is intended to cover the expenses of businesses, and the calculations are made accordingly to the fluctuations in the market.

To start using the Trip Log feature on GPSLive, you need one of these tracker models:

Rewire Security DB1 Advanced, DB1-Lite, DB2, DB3 or DB4

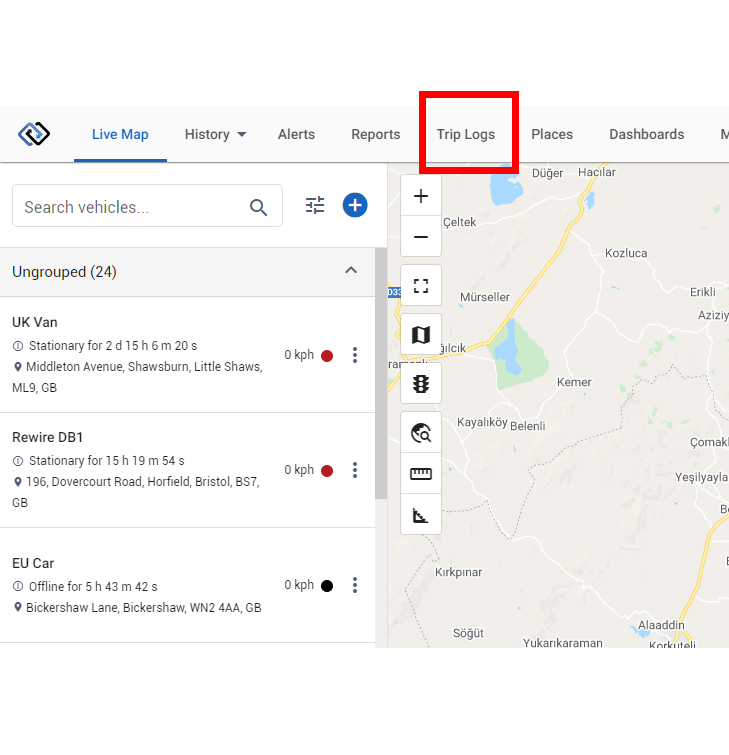

Once you have one of these tracking devices installed in the vehicles on your fleet, all you have to do is to click on “Trip Log” on the top panel on GPSLive;

Select the vehicle you want to set the trips between Business and Private from the list, and then click on either; Business, Private and Skip from the trips list;

Once your mileage is distinguished between Business and Private, you will be ready to get a report printed out for providing HMRC as proof of your tax-deductible business mileage.